VAT(Value Added Tax) In the GCC Countries

Value-added tax (VAT) is a tax on the consumption of goods and services. In 2018, the Gulf Cooperation Council (GCC) implemented a VAT system across its member countries, which include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. This article will explore the basics of VAT under GCC and its implications for businesses and consumers.

- Basic food items such as bread, rice, and fresh vegetables are subject to a zero VAT rate.

- Healthcare services and medicines are exempt from VAT.

- Education services and related goods such as textbooks and school supplies are also exempt from VAT.

- Residential property sales and rentals are subject to a zero VAT rate, while commercial property sales and rentals are subject to the standard 5% VAT rate.

- Financial services such as loans, insurance, and investments are exempt from VAT.

What is VAT under GCC?

VAT under GCC is a tax levied on the supply of goods and services within the GCC countries. The standard rate of VAT is set at 5%, although certain goods and services may be exempt or subject to a reduced rate. VAT is collected at every stage of the supply chain, from production to distribution to final consumption. Businesses are required to register for VAT if their annual turnover exceeds the registration threshold of AED 375,000.

VAT Laws:

View UAE tax laws and procedures (VAT and excise) on the website of the Federal Tax Authority.

Useful links:

- Federal decree-law No. 8 of 2017 on value added tax (PDF, 1 MB)

- UAE Cabinet Decision 52 of 2017 on the executive regulations of the Federal Decree Law No. (8) of 2017 on Value Added Tax

- Federal law by decree No. 13 of 2016 concerning the establishment of the Federal Tax Authority (PDF, 1.5 MB)

- VAT FAQs – Federal Tax Authority

Criteria for registering for VAT

A business must register for VAT if its taxable supplies and imports exceed AED 375,000 per annum.

It is optional for businesses whose supplies and imports exceed AED 187,500 per annum.

A business house pays the government, the tax that it collects from its customers. At the same time, it receives a refund from the government on tax that it has paid to its suppliers.

Foreign businesses may also recover the VAT they incur when visiting the UAE.

Read more on VAT registration:

What are the implications of VAT for businesses?

VAT has significant implications for businesses operating in the GCC countries. Firstly, businesses must ensure that they are compliant with the VAT regulations and that they are charging the correct amount of VAT on their goods and services. Failure to comply can result in penalties and fines. Secondly, businesses must maintain accurate records of their VAT transactions, including invoices, receipts, and VAT returns. This can be a significant administrative burden for businesses, particularly those that operate across multiple GCC countries.

What are the benefits of VAT under GCC?

VAT under GCC has several benefits, including:

- Diversification of revenue: VAT provides a new source of revenue for the GCC countries, which have historically relied on oil exports for their income. This diversification of revenue can help to mitigate the impact of fluctuations in oil prices.

- Increased government revenue: VAT is expected to generate significant revenue for the GCC governments, which can be used to fund public services and infrastructure projects.

- Increased transparency: VAT provides a more transparent and efficient way of collecting tax revenue, as it is collected at every stage of the supply chain.

In conclusion, VAT under GCC is a significant development for businesses and consumers in the region. While it may present challenges for businesses in terms of compliance and administration, it has the potential to generate significant revenue for the GCC governments and to provide a more transparent and efficient way of collecting tax revenue. Consumers can expect to see an increase in prices for certain goods and services, but basic necessities are exempt from VAT.

How to register for VAT?

Businesses can register for VAT through the eServices section on the FTA website. However, they need to create an account first. For more details about VAT registration, please read VAT registration User Guide (PDF).

How is VAT collected?

VAT-registered businesses collect the amount on behalf of the government; consumers bear the VAT in the form of a 5 per cent increase in the cost of taxable goods and services they purchase in the UAE.

UAE imposes VAT on tax-registered businesses at a rate of 5 per cent on a taxable supply of goods or services at each step of the supply chain.

Tourists in the UAE also pay VAT at the point of sale.

Implication of VAT on businesses

Businesses will be responsible for carefully documenting their business income, costs and associated VAT charges.

Registered businesses and traders will charge VAT to all of their customers at the prevailing rate and incur VAT on goods/services that they buy from suppliers. The difference between these sums is reclaimed or paid to the government.

How ACCU360 can help you to streamline your business according to all new taxes and compliance requirement?

In ACCU360 ERP you can easily meet all your digital transformation and meet all the compliances. Right starting from VAT system to corporate tax and E-Invoicing you can in ACCU360 ERP.

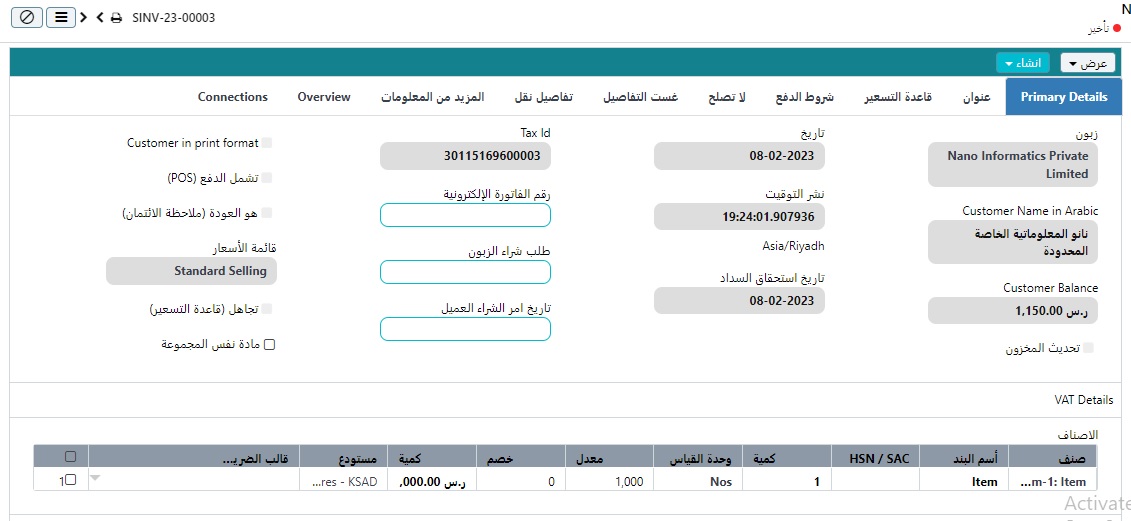

Sales Invoice Arabic Version

Accounting Module